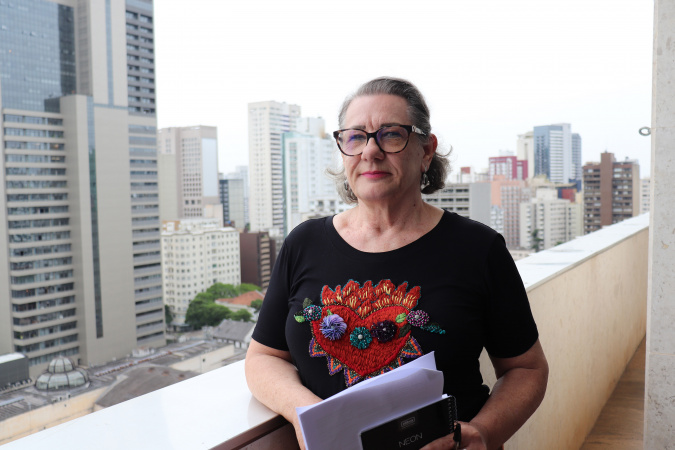

The reform of the taxation of goods and services currently being examined by the National Congress is about to be voted on in the first round in the Senate, but, for the tax controller Gedalva Baratto, of the Secretariat of Finance of Paraná, the content of the proposal and the heart of the discussions has been known for a long time. After decades of working in the complex world of state taxes and closely following constitutional amendments, companion laws and mini-reforms, the direction of the debates is unlikely to surprise her.

Gedalva is an authority on the subject, a subject that is at the forefront of state interests, and is one of many Paraná officials who have contributed to Paraná’s progress on several fronts. In reference to Waiter’s Day, celebrated on the 28th, the Paraná News Agency tells the story of some of these remarkable characters, who improve the services provided to citizens.

It’s not easy to find people with as much technical knowledge as Gedalva about the economic impacts resulting from tax changes.

“Other previous attempts at reform of this nature were also quite extensive and the subject of long and complex discussions, but the current reform is moving very quickly. Everything suggests that it will not fall into the drawers, as was the case for past initiatives,” she reports, listing and citing the details of at least ten proposed amendments and projects. of law, approved or not after the Federal Constitution of 1988.

Gedalva chose public service as a path in 1976, while working at the Paraná Institute for Economic and Social Development (Ipardes). In 1980 he passed the exam and began his career in the Revenue Service of the State of Paraná. “I was a researcher, I didn’t identify much with inspection activities, so shortly after I resumed analysis and study work at the Economic Council.”

The auditor currently works within the Council of Economic and Fiscal Affairs (AAET) of the Secretariat of Finance and, in 2021, was the first person to receive the Medal of Financial Merit of the State of Paraná, which pays tribute to employees, professionals and academics in the field of national, state and municipal finance who contribute to economic and social development and the balance of public finances.

Alongside her public service, she taught for a few years at the Faculty of Administration and Economics (FAE), where she also obtained her degree in economics. Throughout his professional activity, he has completed three specialist courses and a master’s degree, in areas covering aspects of economic development, tax law and public finance.

To some, his fascination with a subject as obscure as taxation may seem strange, but Gedalva speaks about it with genuine passion, even if political biases often trump the highly technical opinions he advocates. Enthusiasm is particularly evident when it comes to the controversial subject of fiscal federalism and resource sharing within federations.

“This theme has always been present in my activities and I am not modest. I think my work has helped bring resources to Paraná. It is an intrinsically conflictual area, you have to be present and persevering, weighing the contradictions and alternative solutions, with coherent arguments and numerous figures.”

BRAZILIAN FORUM – As she works on sensitive topics and advises financial secretaries, the auditor’s publications are not numerous. It was his active participation in the Fiscal Forum of Brazilian States (FFEB) that gave him the opportunity to publish articles, such as “Aspects of Subnational Taxation in Brazil” (“Aspects of Subnational Taxes in Brazil”) in the Forum review. federations, an organization headquartered in Canada that brings together representatives from countries that adopt federalism as a form of political-administrative organization.

The period as director of the Fiscal Forum of Brazilian States (FFEB) for Paraná was very enriching, allowing Gedalva to participate in the organization of international missions and seminars, with high-level discussions on her favorite topic: tax systems in federations, ranging from hybrid to supranational, such as the European Union, to typical federative unions, such as the United States, India, Australia, Spain, Germany, Canada , Mexico, Brazil, among others.

The employee plays an active role in the Quantification Working Group (GT-08), providing financial advice to the Finance Secretaries, the National Financial Policy Council (Confaz) and the National Committee of Finance Secretaries. State of Finance (Comsefaz). The GT-08, which she helped coordinate for nearly 30 years, is responsible for quantifying the impacts of tax reform proposals.

CURRENT PROPOSAL – With the current proposal, which removes ICMS and other taxes and then unifies them into two value-added taxes, it is easy to imagine that GT-08 is in high demand. “The Kandir Law, for example, brought about profound changes in the ICMS in 1996 and has always required a lot of calculation and patience on the part of the members of the Group, to subsidize the negotiations with the Union and obtain compensation for loss of income.

During his nearly 50 years of public service, it would be impossible to list the programs and projects he helped implement.. She jokes: “As I am very old, I had the honor of participating in work with renowned tax specialists, such as Luiz Fernando Van Der Broocke from Paraná and Fernando Rezende from Rio de Janeiro”, referring to the tax specialist and former Secretary of State of Paraná. Finance and economist and former president of Ipea, respectively.

Gedalva also remembers the establishment of the 1988 Constituent Assembly as another defining moment in his career. It was a time when we saw transformative initiatives – such as a new federal sharing, the institution of hydroelectric royalties – leave the discussions and be applied to the real world. “Texts with a technical basis went to Congress and were approved without a comma leaving its place,” he says with good humor.

But she also sees present and future advances, including in the logic of action of tax agents, whose role is increasingly closer to data analysis, to help taxpayers comply with tax rules – a movement which reduces the costs linked to judicialization.

“The more “orientative” auditor profile has been made possible thanks to advances in tax administration and information technology, which enable remote inspections. Even if the reform is not moving forward, the state control system has evolved significantly in the country and this is internationally recognized.

“With a complex tax like the ICMS, it is a miracle that a high level of revenue and efficient management can be achieved. From an operational point of view, there is nothing to fear from a simpler and more rational tax, even if the reform model requires a high degree of intergovernmental cooperation,” says the official.

“Freelance communicator. Hardcore web practitioner. Entrepreneur. Total student. Beer ninja.”