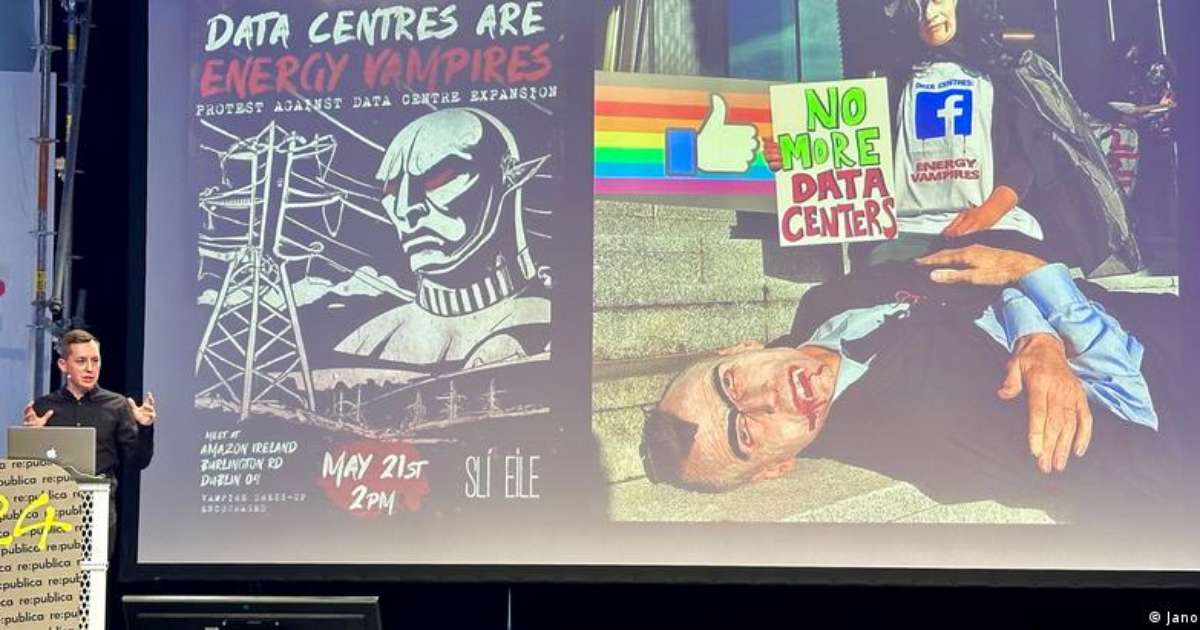

The United States requested, this Friday (30), the opening of consultations with Canada within the framework of the T-MEC free trade agreement, of which Mexico is also a party, for a 3% tax on the income of large technology companies.

Canada’s tax ‘seems contradictory’ [seus] “The commitments” made in the T-MEC “not to treat American companies less favorably than Canadian companies,” the office of the United States Trade Representative said in a statement.

Canada’s digital services tax (DST) was enacted in June and imposes tariffs on international companies such as Amazon, Uber, Airbnb and Netflix, which generate annual global revenues of more than CAD$1.1 billion (R$4.6 billion, at current exchange rates) and annual revenues in Canada exceeding CAD$20 million (R$83.8 million).

“The United States opposes unilateral taxes on digital services that discriminate against American businesses,” U.S. Trade Representative Katherine Tai said in a statement.

She added that her office was taking steps to combat Canada’s “discriminatory policies.”

If there is no agreement within 75 days, the United States could request the creation of a panel to decide the dispute.

Canadian Deputy Prime Minister Chrystia Freeland said in July that Canada was following the lead of other G7 countries such as the United Kingdom, France and Italy.

Ottawa proposed the tax in 2019 but delayed its implementation to allow for the conclusion of negotiations on a global treaty on the taxation of multinationals, which have dragged on without reaching an agreement.

bys-jul/clc/erl/mr/rpr/mvv

© Agence France-Presse

“Pop culture fan. Coffee expert. Bacon nerd. Infuriatingly humble communicator. Friendly gamer.”