Florida Governor Ron DeSantis has his sights set on the next horizon in his administration’s battle in the so-called culture wars: “CEOs have woken up.”

The Republican governor, seen as a likely candidate for the 2024 presidential election, said during a press conference last week that it plans to take on money transfer giants such as PayPal, as well as investment funds and banks that try to impose a so-called “conventional ideology” on their potential customers. He also hopes to introduce a wave of legislative and executive initiatives that would undermine the ability of these companies to “discriminate” against customers based on their political or religious beliefs.

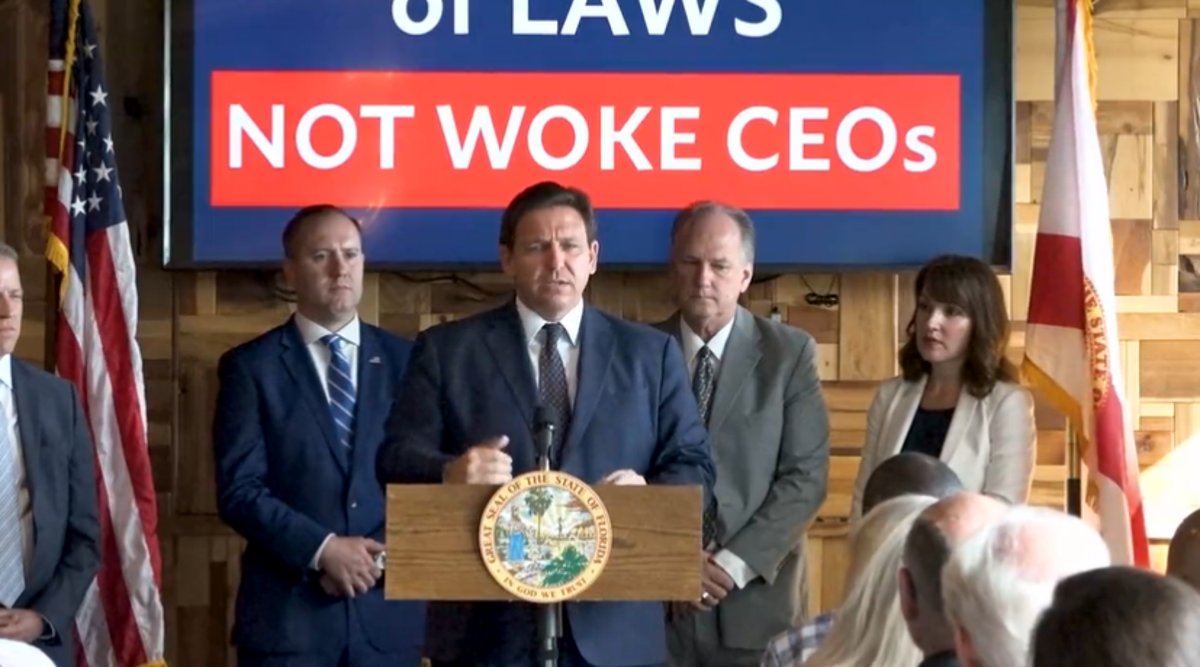

“Do we govern ourselves by our constitution and by our elections or do we have these masters of the universe occupying these commanding heights of society?” Governor DeSantis asked rhetorically on Wednesday as he stood in front of a sign with the words: “Government of Laws. This did not wake up the CEOs.

Financial services such as banks, credit card companies and transfer services “should not collude with each other to marginalize people with whom they have political differences,” Gov. DeSantis said, before designating PayPal.

The San Jose, Calif.-based money transfer service recently drew the ire of the incendiary politician following an allegation that the tech company froze the account of a Florida-based nonprofit in April , after raising funds to fight “gender ideology”. taught in schools.

“[PayPal] cut off people they disagree with,” Moms for Liberty co-founder Tina Descovich said, according to Bloomberg News.

In April, the conservative group allegedly raised more than $100,000 before its account was frozen, Descovich said, saying it had “stopped our organization to an extreme point.”

“They use things like social credit scores to marginalize people they don’t like,” the Florida governor said, before citing the specific case of Moms for Liberty.

He also referenced an earlier case in February, when online fundraising site GoFundMe shut down campaigns by those involved in the Canadian Trucker Protests, where protesters actually brought the nation’s capital to a screeching halt.

“We are also going to make it very clear that discrimination, especially in the financial sector, is not something we want to see here in the State of Florida,” Governor DeSantis continued, before offering to d other states dominated by red – such as Texas, Tennessee and Arizona, could follow suit.

“We would have a lot of money, a lot of voting power under management,” he said, noting that the four southern belt states could serve as a “real check” against financial excesses.

The Florida governor’s remarks on the financial sector follow the Securities and Exchange Commission’s proposed new rules that would require publicly traded companies to step up their reporting on ESG – the environment, social impact and corporate governance – Intel.

the federal agency announced possible changes to company filings earlier this year. The initial hope of the changes is that the regulator can stem some of the unchecked greenwashing — essentially, companies that aim to achieve green goals without ever committing to real action — that has taken off as green investing has become increasingly popular. .

One of the proposed new rules would require such companies to disclose the potential risks an investment with the company would pose due to the climate crisis; specifically, describing how extreme weather events, such as droughts, hurricanes, floods, or even supply chain crises caused by extreme weather conditions, can affect business value.

Another suggestion the SEC has put forward as a requirement is that companies disclose data on their emissions, both directly (for example, from pollution created in factories) and indirectly (for example, through the use of electricity used to power an office building). ).

Details of Governor DeSantis’ executive and legislative proposals have yet to be fully announced, but one detail he made explicit during Wednesday’s speech was that he intended to have pension managers invest in the ‘State in funds solely based on the ability of the investment to generate a profit, and disregard other considerations.

“Pop culture fan. Coffee expert. Bacon nerd. Infuriatingly humble communicator. Friendly gamer.”